Finprop Review

FinProp Funding is a forward-thinking proprietary trading firm designed to empower traders with innovative and cost-efficient solutions.By focusing on providing a user-centric approach, FinProp Funding aims to redefine the trading landscape and offer unparalleled support to its clients.

Pros

Account sizes up to 100 000$

Biweekly payouts

80% profit split

Weekend holding allowed

Overnight holding allowed

No maximum trading days

Forex pairs,crypto pairs,commodities and indices available

Offers 03 funding programs

Cons

No refundable fees on prime challenge

FinProp Funding combines innovation and empowerment to redefine proprietary trading for today’s market demands Combining innovation and unmatched trader support, FinProp builds trust and opportunity for all who seek financial independence in trading.

What To Know About Finprop Funding ?

Established in 2024, Finprop, sets apart with its unique “Pay as you Pass” model, allowing traders to manage their expenses with greater flexibility and control. This feature eliminates the upfront financial pressure typically associated with trading challenges, making it an attractive option for both new and experienced traders. Finprop also offers multiple programs with accounts sizes upto $100,000.

Funding Programs Offered

Finprop offers three unique challenge programs designed to accommodate various trading styles

- FinProp Prime Challenge

- FinProp Standard Challenge

- FinProp Pro Challenge

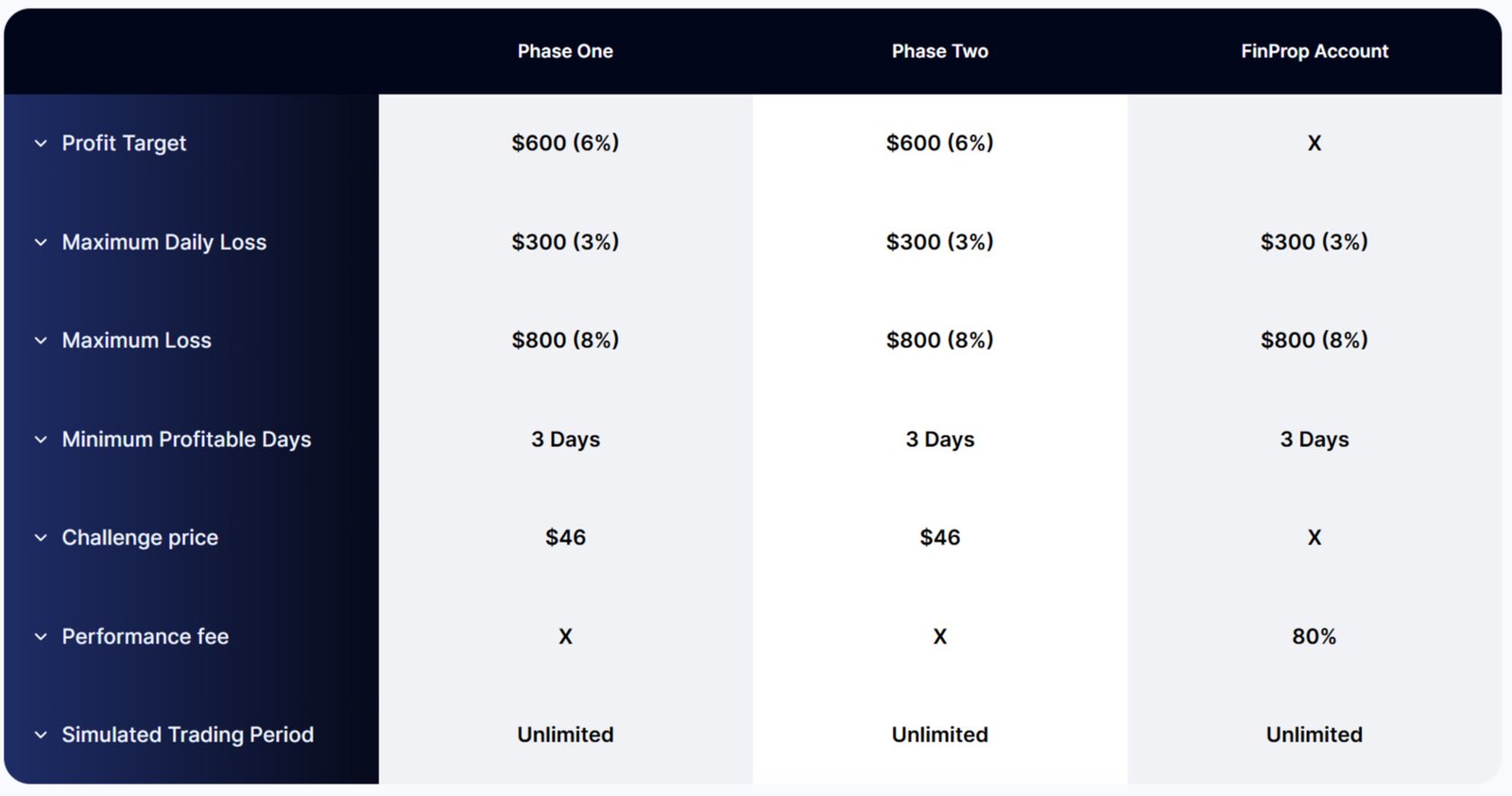

Finprop Prime Challenge Overview

FinProp Prime Challenge offers a 2-step evaluation with a “pay as you pass” program. This program permits traders to pay half of the account fee upfront and the rest after passing phase 1. This program includes accounts up to $100,000 with a biweekly payouts.

| Account size | Price |

|---|---|

| $10,000 | $39 |

| $25,000 | $84 |

| $50,000 | $143 |

| $75,000 | $194 |

| $100,000 | $269 |

The evaluation phase requires traders to achieve a unique profit target of 6% during phase 1 and 6% during phase 2, with a daily loss limit of 3% and a maximum overall loss of 8%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate with no time limit.

FinProp Prime Challenge Rules & Parameters

Profit Target: During the evaluation phases only, a profit performance of 6% is required during phase 1 and 6% during phase 2.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 3% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 8% for all trading account sizes during the evaluation and funded stage.

Minimum Profitable Days: Traders are to trade for a minimum of 3 days, realising 0.5% profits in each of these days.

Maximum Trading Days: There are no time limits on all accounts.

Challenge Add-ons

.90% profit splits

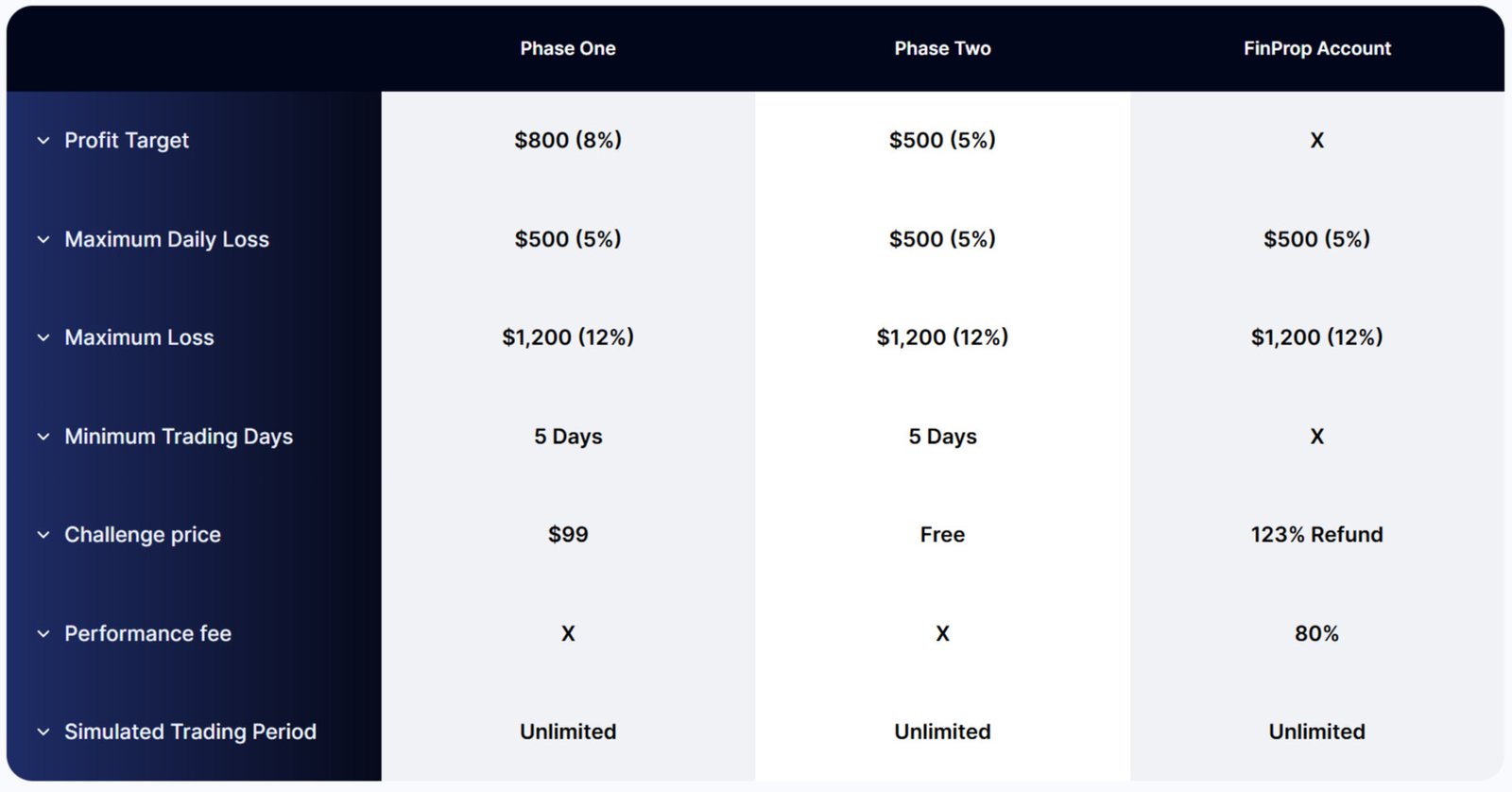

FinProp Standard Challenge Overview

FinProp Standard Challenge Program offers a 2-phase funding solution for traders. This program includes accounts up to $100,000.

| Account size | Price |

|---|---|

| $10,000 | $84 |

| $25,000 | $169 |

| $50,000 | $262 |

| $75,000 | $407 |

| $100,000 | $466 |

The evaluation phase requires traders to achieve a profit target of 8% during phase 1 and 5% at phase 2, with a daily loss limit of 5% and a maximum overall loss limit of 12%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate with no stop-loss requirement.

Standard Challenge Rules & Parameters

Profit Target: During the evaluation phases only, a profit performance of 8% is required during phase 1 and 5% during phase 2.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 5% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 12% for all trading account sizes during the evaluation and funded stage.

Minimum Trading Days: Traders are to trade for 5 days minimum.

Maximum Trading Days: There are no time limits on all accounts.

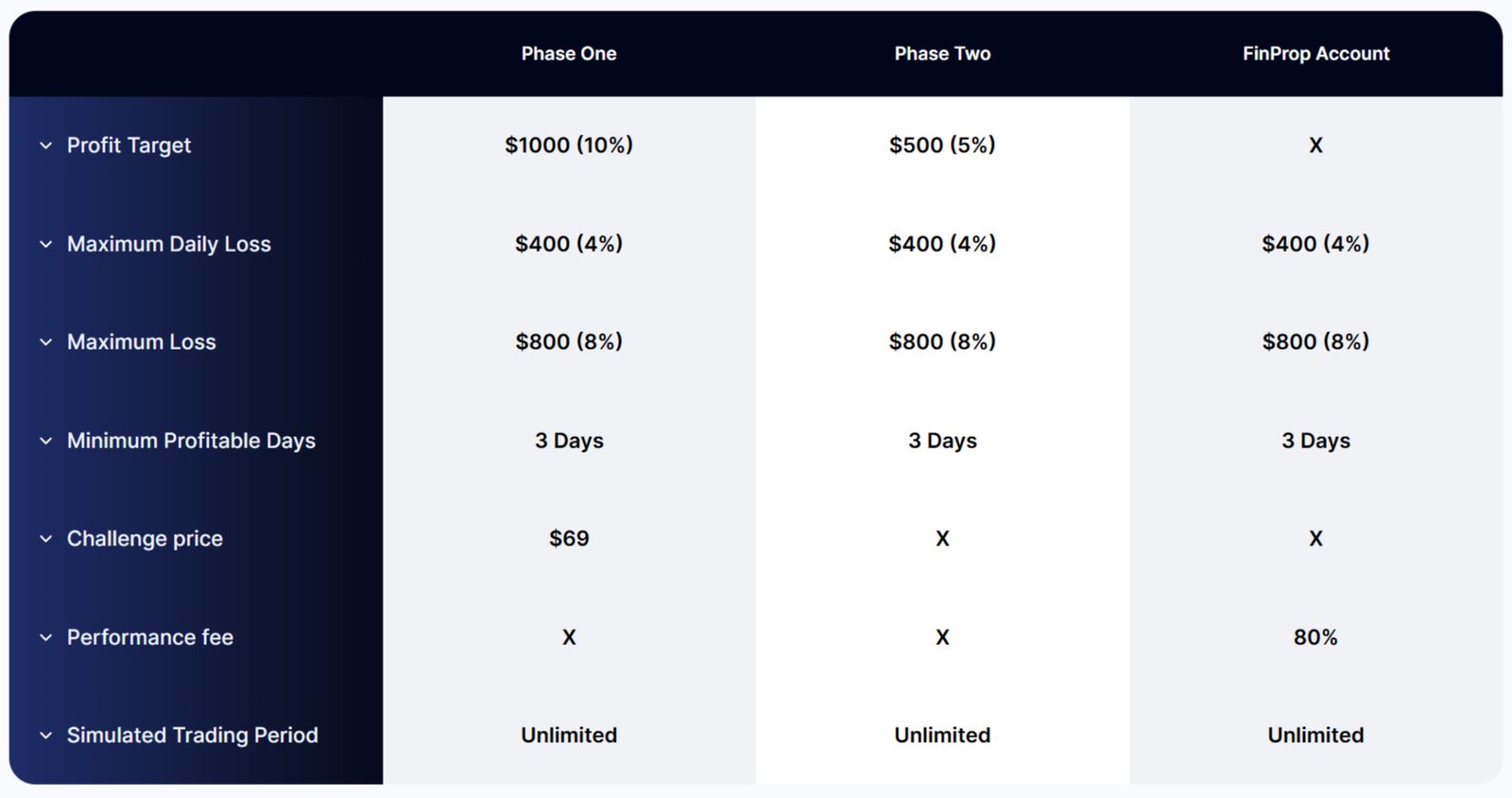

FinProp Pro Challenge Overview

FinProp Pro Challenge offers a 2-step funding solution for traders. This program includes accounts up to $100,000 with no time limit.

| Account size | Price |

|---|---|

| $10,000 | $58 |

| $25,000 | $135 |

| $50,000 | $211 |

| $75,000 | $330 |

| $100,000 | $381 |

The evaluation phase requires traders to achieve a profit target of 10% during phase 1 and 5% during phase 2, with a daily loss limit of 4% and a maximum overall loss of 8%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate.

FinProp Pro Challenge Rules & Parameters

Profit Target: During the evaluation phases, a profit performance of 10% is required during phase 1, and 5% during phase 2.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 4% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 8% for all trading account sizes during the evaluation and funded stage.

Minimum Profitable Days: Traders are to trade for 3 days realizing 0.5% each of the days.

Maximum Trading Days: There is no time limit to pass the challenge.

payout proofs

FinProp funding guarantees fast payouts within 24 hours, giving you the confidence and convenience you deserve. No delays, no uncertainty, just reliable access to your funds when you need them most. Whether you’re reinvesting in your system or enjoying the rewards of your effort, our swift payout process ensures your financial goals aren’t put on hold. Trade smarter and experience the difference with FinProp’s unmatched speed and dependability!

What Are the Key Differences Between FinProp and Other Prop Firms?

FinProp combines innovation with integrity. Their unique evaluation programs are designed to unlock your potential, while their transparent approach ensures you’re always in the know. With lightning-fast payouts, biweekly payouts, and 80% profit splits for their traders, “pay as you pass program” it truly sets them apart from the competition.

Example of comparison between FinProp and FTMO (Read FTMO Review)

| Guide | FinProp | FTMO |

|---|---|---|

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 12% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 calendar days |

| Maximum Trading Period | Phase 1: Unlimited, Phase 2: Unlimited | Phase 1: Unlimited, Phase 2: Unlimited |

| Profit Split | 80% | 80% |

Example of comparison between FinProp and Monevis (Read Monevis Review)

| Guide | FinProp | FXIFY |

|---|---|---|

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 12% | 10% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited, Phase 2: Unlimited | Phase 1: Unlimited, Phase 2: Unlimited |

| Profit Split | 80% | 75% up to 85% |

Trading Platforms

FinProp provides traders with access to the powerful cTrader platform, known for its intuitive interface and advanced trading tools. With features like lightning-fast execution, detailed charting, and algorithmic trading options, cTrader empowers users to make informed decisions and optimize their strategies. FinProp‘s choice of this platform ensures traders have everything they need to achieve their goals efficiently and confidently.

Restricted Countries

FinProp restricts access in certain countries due to legal, regulatory, and financial reasons. These restrictions help ensure compliance with international laws and local trading restrictions. Some countries have specific rules or currency controls that prevent FinProp from offering its services, so the firm limits its availability to stay within legal boundaries and maintain a secure trading environment. These restricted countries include Afghanistan, Central African Republic, Congo (Brazzaville), Congo (Kinshasa), Cuba, Guinea, Iran, Iraq, Korea North, Libya, Mali, Somalia, South Sudan, Sudan, Syria, Venezuela, Yemen, Albania, Vietnam, Malaysia, Kosovo, Burma, Ethiopia, Lebanon, Nicaragua, Zimbabwe, and the USA.

What Instruments Are Available To Trade?

FinProp offers Forex, commodities, indices, stocks, bonds, cryptocurrencies, and many more as trading instruments, with all of them being different and providing room to traders to trade on different markets.

Is FinProp the Right Choice for You?

Selecting the appropriate prop firm can significantly impact your trading career. FinProp stands out by offering a range of trader-focused features designed to help you succeed.

With their Pay as You Pass program, you can spread the cost of evaluations, reducing upfront expenses and easing your financial burden. Plus, FinProp sets you free from the pressure of deadlines by offering no time limits. Take your time, perfect your trades, and pass at your own pace.

FinProp rewards your hard work with 80% profit splits, ensuring that the majority of earnings directly benefit you. And to make it even better, you can enjoy bi-weekly payouts, giving you faster access to your profits when they matter most.

If flexibility, financial incentives, and a supportive environment matter to you, FinProp could be exactly what you’re looking for.

Check Here to see reviews about industry leading proprietry firms in 2025.