FTMO Review 2025

FTMO is a well-known and reputable name in the proprietary trading world. With a mission to empower traders and redefine the prop firm industry, this firm has built its foundation on trust, transparency, and trader-centric practices. By offering access to significant capital and robust trading support, Ftmo has helped thousands of traders achieve their financial goals.

Pros

4.8/5 score on trustpilot

Account sizes up to 200 000$

leverage upto 1:100

First payout after 14 days

90% profit split

Balance-based drawdown

Overnight and weekend holding allowed

No maximum trading days

Large variety of trading instruments available (Forex pairs,crypto pairs,commodities and indices available)

Trading psychologists available

Cons

News trading not allowed

High prices

What To Know About FTMO

Established in 2015, FTMO, with headquarters in Prague, Czech Republic, has shown its promise to empower traders from all over the world. With its CEO, Otakar Suffner, at the helm, FTMO is an increasingly sought-after propfirm that gives traders the chance to showcase and hone their trading and risk management skills. With its proprietary and unique evaluation process, combined with an unparalleled support system, FTMO has established a name for itself in the proprietary trading industry, where every trader is fitted with the tools necessary to thrive.

Funding Programs Offered

FTMO provides a simplified, unique 2-step evaluation system for capital allocation. This unique program is ”The Evaluation program” and involves three types of accounts, which are standard, aggressive, and swing accounts.

The Standard account is for conservative traders with a favorable strategy who aim for modest returns over an extended period of time.

The Aggressive account is for people who have a good risk management strategy and are willing to incur substantial risk for higher returns.

The Swing account is for people who trade over a longer timeline and in the volumes when the market is moving rather than small shifts.

This strategic structure is designed to accommodate various trading styles and risk levels, ensuring an optimal fit for each trader. These various account types allow traders to leverage their strengths in tailored environments, maximizing their potential.

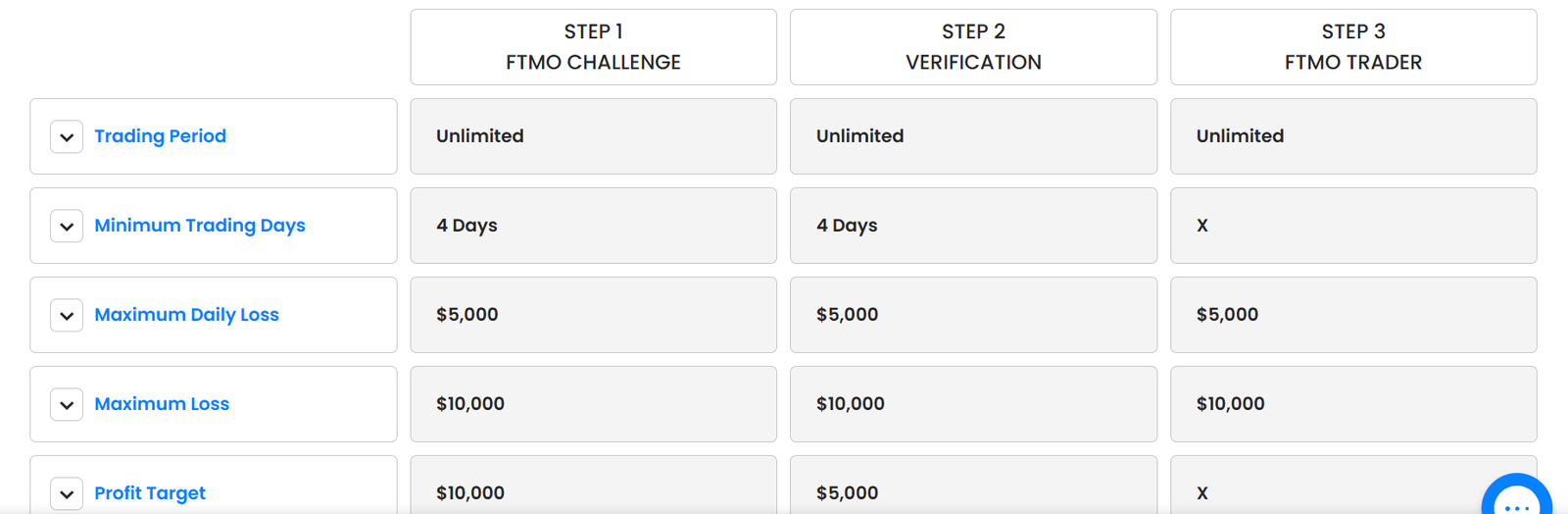

An Overview Of The FTMO Challenge

The Evaluation Program

The FTMO Evaluation process is made to identify disciplined and skilled traders while focusing on different trading styles. During the first phase, traders are restrained with a maximum drawdown and a daily drawdown limit of 10% and 5%, respectively, in return needing a total of 10% profits on their account. Even though there are no maximum trading days, there is a minimum requirement of 4 trading days.

The second phase is the verification stage.A reduced target of 5% profits is put in place with the same parameters as phase 1 of 10% max drawdown and 5% daily drawdown. This stage seals the ability of the trader in all conditions, including the funded account case scenarios as well as how the trader was able to manage risk. Again, as in phase 1, there are no maximum trading days, but the minimum requirement for the number of completed trading days to move to the funded stage is four with leverage still of 1:100.

After successfully completing both phases, a trader is issued a funded account. Traders are rewarded with a 90% profit split, which is one of the best ratios in the industry. On top of that, the evaluation fee is also returned in full after completing the two phases, further proving the company’s interest in assisting its traders. This whole evaluation process, in combination with good profit splitting and low risk parameters, makes it the ideal propfirm for traders who prefer straightforward and profitable proprietary trading.

A Look At Account Sizes And Their Fees

.| Account Size | Price |

|---|---|

| $10,000 | $94 |

| $25,000 | $265 |

| $50,000 | $366 |

| $100,000 | $574 |

| $200,000 | $1,148 |

The Evaluation Program Scaling Plan

Trading Rules And Objectives

Profit Targets: Traders must achieve a profit target of 10% during Phase 1 of the evaluation process. Once this is successfully completed, they move to Phase 2, where the profit target is reduced to 5%. Both phases must be completed within the set trading parameters to qualify for a funded account.Daily Loss Limit: A strict daily loss limit of 5% is enforced, meaning traders are not allowed to lose more than 5% of their account balance in a single trading day. If this limit is breached, the evaluation process will be terminated, regardless of other trading performance metrics.

Max Loss Limit: The maximum allowable loss on the account is capped at 10% of the initial account size. This includes all cumulative losses incurred during the evaluation phase and acts as the final threshold for risk tolerance within the program.

Minimum Trading Days: Traders are required to actively trade for at least four separate trading days during each phase of the evaluation.

No Weekend Holding: All opened positions must be closed before the market closes for the weekend. Traders are to close all opened positions before market closure on Friday market.

News Trading Not Permitted: Trading during high-impact economic news events is strictly prohibited. This includes all trades executed within a 2-minute window before and after such events.

No Account Management: The trader must manage the account independently designed to assess the trader’s personal trading skills and decision-making capabilities.

What Instruments Are Available To Trade?

| AUDCAD | AUDJPY | AUDNZD | AUDCHF | AUDUSD | EURRUB |

| GBPAUD | GBPCAD | GBPJPY | GBPNZD | GBPCHF | GBPUSD |

| CADJPY | CADCHF | EURAUD | EURGBP | EURCAD | EURJPY |

| EURCHF | EURUSD | EURNZD | NZDCAD | NZDCHF | NZDJPY |

| NZDUSD | CHFJPY | USDCAD | USDCHF | USDJPY | EURCZK |

| EURHUF | EURNOK | EURPLN | USDCZK | USDHKD | USDHUF |

| USDILS | USDMXN | USDNOK | USDPLN | USDRUB | USDZAR |

| USDSEK | USDTRY |

| XAGUSD | XAGEUR | XAGAUD | XAUUSD | XAUEUR | XPTUSD |

| XAUAD | XPDUSD |

| AUS200 | US30 | SPN35 | EU50 | FRA40 |

| GER40 | HK50 | JP225 | US100 | US500 |

| UK100 | UKOil | USOil | VIX |

| AAPL | AIRF | ALVG | AMZN | BABA |

| BAC | BAYGn | DBKGn | FB | GOOG |

| IBE | LVMH | MSFT | NFLX | NVDA |

| PFE | RACE | T | TSLA | V |

| VOWG | WMT | ZM |

| NATGAS | DX | ERBN | USTN10 |

| BTCUSD | DASHUSD | ETHUSD | LTCUSD | XRPUSD |

| XMRUSD | NEOUSD | ADAUSD | DOTUSD | DOGEUSD |

Which Broker To Trade on FTMO?

Payout Proofs

With its successful traders being paid out over $200 million, FTMO has proven that it is willing to pay out traders who are able to perform well in line with the requirements of the platform. Such payouts prove its dedication to ensuring the existence of a realistic trading ecosystem in which profits are fairly and timely disbursed. The platform is quite regular in providing evidence of payouts, thus instilling confidence among the traders regarding the authenticity of the profits earned, helping to further improve FTMO’s reputation as a reliable propfirm across the globe. Below are images of some payout proofs

What Are the Key Differences Between FTMO and Other Prop Firms?

What makes FTMO different from other prop firms is its basic account model structure of a two-step evaluation system with a lot of beneficial features. Traders have a no-time limit, get paid biweekly, and get access to an elite program. During the two-phase evaluation, a profit of 10% has to be attained during Phase 1, followed by 5% in Phase 2, while keeping daily loss to not more than 5% and max loss within 10%. There are no maximum days of trading, as is the case with many firms, but traders need to trade for at least four days in each phase. Its unique scaling plan allows traders to increase the size of their traded account when they accomplish their targets. The earning potential, withdrawals, and pleasant conditions place it as an outstanding propfirm for many traders.

Let’s compare FTMO with other prop firms in the industry to highlight what makes it unique. We’ll examine key differences in evaluation processes, trading conditions, and payout structures.

Example of comparison between FTMO and FundedNext (Stellar) (Read FundedNext Review)

| Guide | FTMO | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 4 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 90% |

Example of comparison between FTMO and E8 Markets (Read E8 Markets Review)

| Trading Objectives | FTMO | E8 Markets |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 8% (Scalable up to 14%) |

| Minimum Trading Days | 4 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% |

Is Achieving FTMO Funding Possible?

Reaching funded stage can be achieved, but it will require personal sacrifice and respecting discipline, as well as having a good trading plan. In its two-step evaluation process, FTMO seeks to evaluate a trader’s consistency and risk management, providing opportunities for professional traders who wish to demonstrate their skills and gain access to funds to advance their trading careers without imposing any deadlines on the evaluation stages and allowing trading whenever they feel ready. If you’re willing to work hard, FTMO has the hard work and discipline to make funded trading a reality.

Trading Platforms

FTMO has created opportunities for traders to trade on multiple platforms that include top-of-the-line options like MetaTrader 4 (MT4), MetaTrader 5 (MT5), DXTrade, and cTrader. All of these trading platforms are liked and trusted in the trading community due to their advanced features and friendly interfaces. The case is different for traders that prefer the classic and popular platforms, cTrader for its novelty and speedy transactions, or DXTrade for its master. FTMO gives the freedom of choice. This versatility guarantees the traders a way to access tools to enable them to implement their strategies regardless of their preferred platforms.

Restricted Countries

FTMO restricts access in certain countries due to legal, regulatory, and financial reasons. These restrictions help ensure compliance with international laws and local trading restrictions. Some countries have specific rules or currency controls that prevent FTMO from offering its services, so the firm limits its availability to stay within legal boundaries and maintain a secure trading environment. Below is a list of countries restricted:| Cuba | Iran | Lebanon | Syria | North Korea | Libya |

| Russia | Sudan | Somalia | South Sudan | Pakistan | Vietnam |

| United Arab Emirates | Hong Kong | Belarus | Myanmar | Central African Republic | Democratic Republic of Congo |

| Congo | Ethiopia | Iraq | Nicaragua | Venezuela | Yemen |

| Philippines | Kenya | Algeria | Morocco |

Check Here to see reviews about industry leading proprietry firms in 2025.