Think Capital Review

Think Capital is revolutionizing the world of trading as a rapidly growing broker-backed prop firm with a vision for excellence, offering competitive profit splits, innovative tools, advanced resources, and a transparent framework designed for traders success.

Pros

leverage upto 1:50

Account sizes up to 300 000$

Trustpilot Rating of 4.1/5

Weekly payouts

80% initial profit split and upto 90%

Weekend holding allowed

Professional dashboard

Overnight holding allowed

No maximum trading days

Forex pairs,crypto pairs,commodities and indices available

Offers 03 funding programs

Cons

Max drawdown only 8% on Dual-Step Challenge without add-on

Daily drawdown only 4% on Dual-step challenge

At Think Capital, empowering traders financially is the core mission, offering customized funding solutions that align seamlessly with their trading goals. Advanced real-time dashboards and metrics simplify the funding process while delivering clear insights into trading performance.

What To Know About Think Capital?

Established in june 2024, Think Capital, Backed by the reputable Think Markets offers 3 unique evaluation programs designed to meet the diverse needs of traders while ensuring fairness and accountability with each program carefully structured to support professional growth.

Funding Programs Offered

Think Capital offers three unique challenge programs designed to accommodate various trading styles

- Lightning Challenge (One-Step Program)

- Dual-step Challenge (Two-Step Program)

- Nexus Challenge (Three-Step Program)

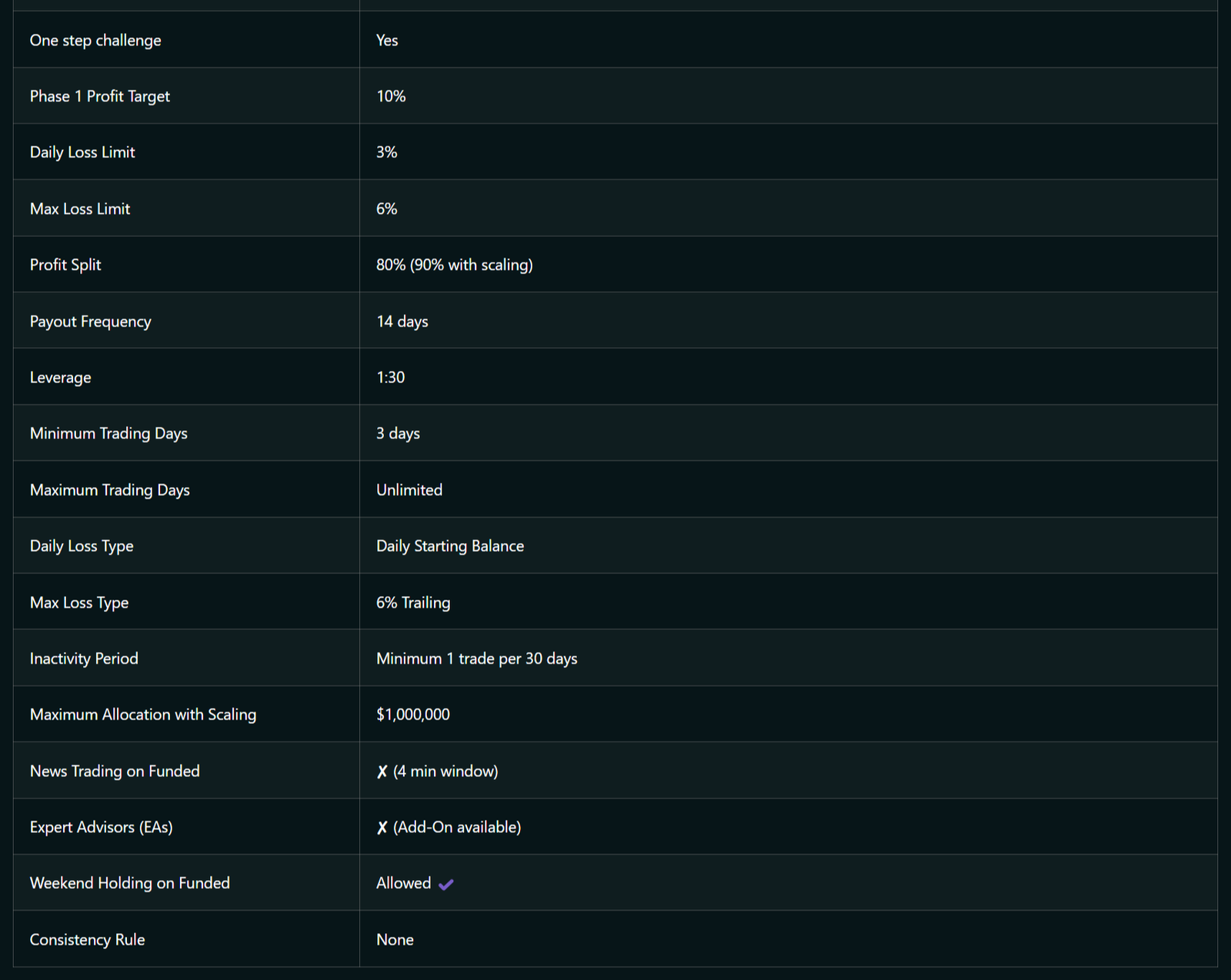

Lightning Challenge Overview

Think Capital Lightning Challenge offers a streamlined, single-step funding solution for traders. This program includes accounts up to $300,000 with a leverage of 1:30. Once funded, traders can start trading immediately and are eligible to withdraw their profits bi-weekly.

| Account size | Price |

|---|---|

| $5,000 | $59 |

| $10,000 | $99 |

| $25,000 | $199 |

| $50,000 | $299 |

| $100,000 | $499 |

| $200,000 | $949 |

| $300,000 | $1,399 |

The evaluation phase requires traders to achieve a unique profit target of 10% during evaluation only, with a daily loss limit of 3% and a maximum overall loss of 6%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate with no time limit.

Lightning Challenge Rules & Parameters

Profit Target: During the evaluation phases only, a profit performance of 10% is required.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 3% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 6% for all trading account sizes during the evaluation and funded stage.

Minimum Trading Days: Traders are to trade for a minimum of 3 days.

Maximum Trading Days: There are no time limits on all accounts.

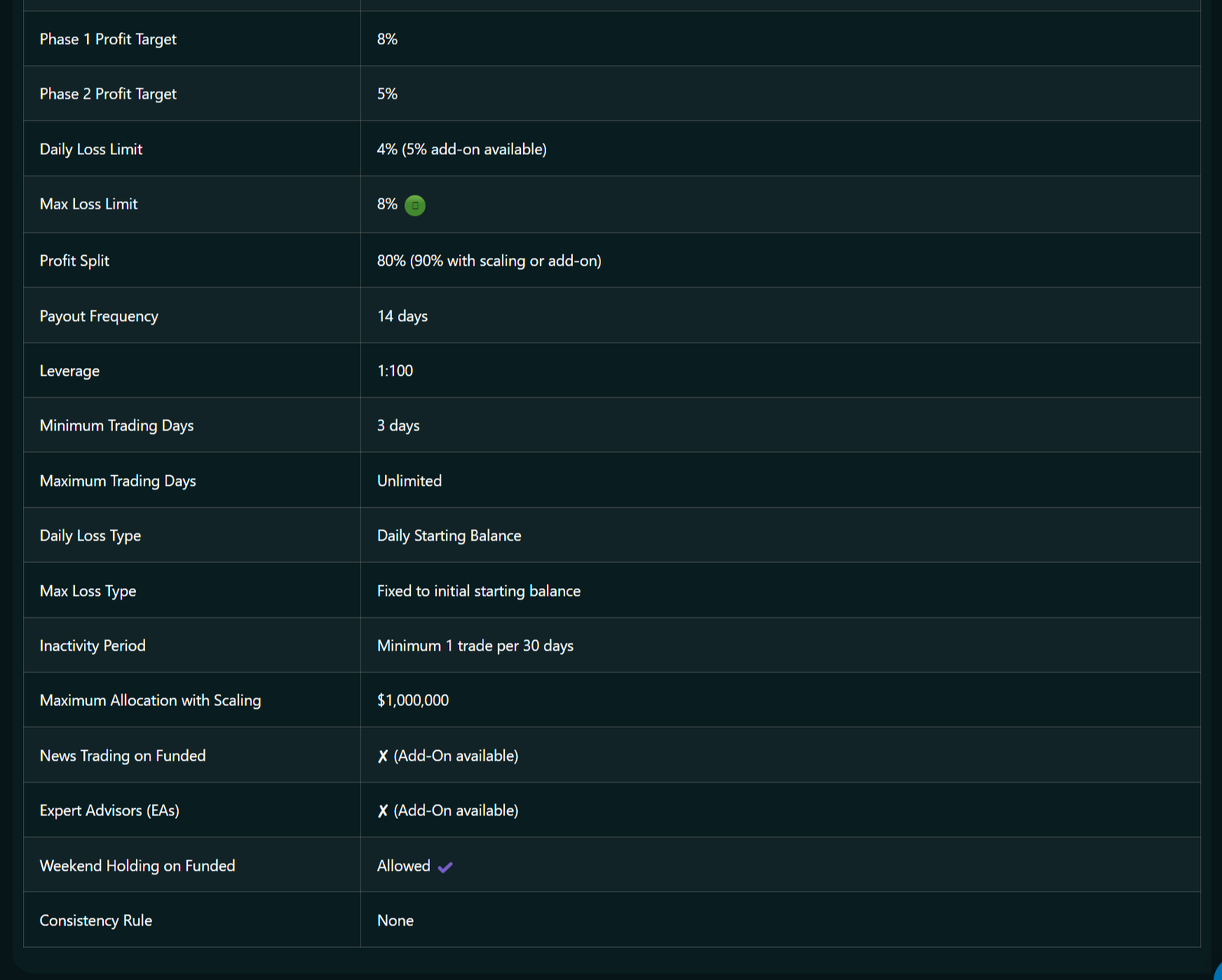

Dual-Step Challenge Overview

Think Capital Dual-StepChallenge Program offers a 2-phases funding solution for traders. This program includes accounts up to $300,000 with a leverage of 1:100. Once funded, traders can start trading immediately and are eligible to withdraw their profits bi-weekly.

| Account size | Price |

|---|---|

| $5,000 | $59 |

| $10,000 | $99 |

| $25,000 | $199 |

| $50,000 | $299 |

| $100,000 | $499 |

| $200,000 | $949 |

| $300,000 | $1,399 |

The evaluation phase requires traders to achieve a profit target of 8% during phase 1 and 5% at phase 2, with a daily loss limit of 4% and a maximum overall loss limit of 8%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate with no stop-loss requirement.

Dual-Step Challenge Rules & Parameters

Profit Target: During the evaluation phases only, a profit performance of 8% is required during phase 1 and 5% during phase 2.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 4% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 8% for all trading account sizes during the evaluation and funded stage.

Minimum Trading Days: Traders are to trade for 3 days minimum.

Maximum Trading Days: There are no time limits on all accounts.

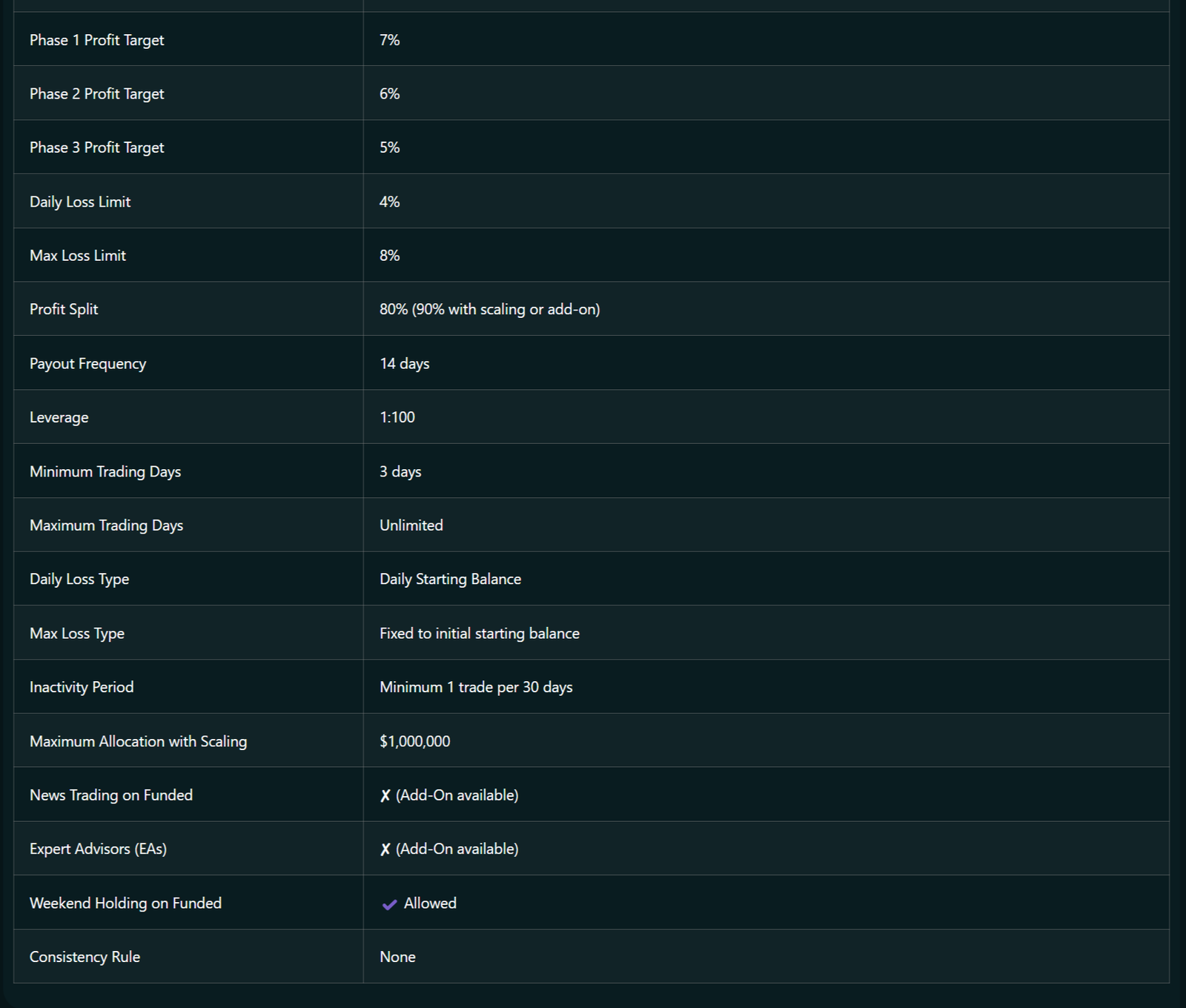

Nexus Challenge Overview

Think Capital Nexus challenge offers a three-step funding solution for traders. This program includes accounts up to $300,000 with a leverage of 1:100. Once funded, traders can start trading immediately and are eligible to withdraw their profits bi-weekly.

| Account size | Price |

|---|---|

| $5,000 | $39 |

| $10,000 | $79 |

| $25,000 | $139 |

| $50,000 | $199 |

| $100,000 | $349 |

| $200,000 | $649 |

| $300,000 | $949 |

The evaluation phase requires traders to achieve a profit target of 7% during phase 1, 6% during phase 2 and 5% during phase 3, with a daily trailing loss limit of 4% and a maximum overall loss of 8%. Upon passing, traders move to the funded account, where they keep 80% of profits they generate with no time limit.

Rapid Challenge Rules & Parameters

Profit Target: During the evaluation phases, a profit performance of 7% is required during phase 1, 6% during phase 2 and 5% during phase 3.

Daily Loss Limit: All accounts are assigned a maximum daily loss threshold, set at 4% for all account sizes, which they cannot exceed in a single trading day.

Max Loss Limit: The maximum loss is set at 8% for all trading account sizes during the evaluation and funded stage.

Minimum Trading Days: Traders are to trade for 3 days during all stages.

Maximum Trading Days: There is no time limit to pass the challenge.

Which Broker To Trade On Think Capital ?

As mentioned before, Think Capital is backed by the reputable Think Markets. Traders can trade on platforms like; Think trader (includes TradingView charts and comprehensive functionality) and MetaTrader 5.

payout proofs

What Are the Key Differences Between Think capital and Other Prop Firms?

Think Capital combines innovation with integrity. Their unique evaluation programs are designed to unlock your potential, while their transparent approach ensures you’re always in the know. With lightning-fast payouts, weekly payouts and 90% profit splits for their traders, it truly sets them apart from the competition.

Example of comparison between Think Capital and Blueberry Funded (Read Blueberry Funded Review)

| Guide | Think Capital | Blueberry Funded |

|---|---|---|

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% upto 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 3 calendar days |

| Maximum Trading Period | Phase 1: Unlimited, Phase 2: Unlimited | Phase 1: Unlimited, Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% |

Example of comparison between Think Capital and FXIFY (Read FXIFY Review)

| Guide | Think Capital | FXIFY |

|---|---|---|

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 8% upto 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited, Phase 2: Unlimited | Phase 1: Unlimited, Phase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% up to 90% |

Is Getting Think Capital Funding Possible?

Reaching the funded stage can be achieved, but it will require personal sacrifice and respecting discipline, as well as having a good trading plan. In its evaluation models, Think Capital seeks to evaluate a trader’s consistency and risk management, providing opportunities for professional traders who wish to demonstrate their skills and gain access to funds to advance their trading careers without imposing any deadlines on the evaluation stages and allowing trading whenever they feel ready.

Trading Platforms

Think Capital elevates trading convenience by providing a wide range of platforms such as Think Trader, MetaTrader 5, and Tradingview. These numerous platforms ensure that traders of all experience levels can find a platform that fits their style and needs. Whether you’re looking for cutting-edge features, user-friendly interfaces, or advanced analytical tools, these platforms deliver unmatched flexibility and functionality. By catering to diverse preferences, Think Capital empowers its traders to make confident, informed decisions in a seamless environment, enhancing their overall trading experience.

Restricted Countries

Think Capital restricts access in certain countries due to legal, regulatory, and financial reasons. These restrictions help ensure compliance with international laws and local trading restrictions. Some countries have specific rules or currency controls that prevent Think Capital from offering its services, so the firm limits its availability to stay within legal boundaries and maintain a secure trading environment. These restricted countries include;

| Countries | |||

|---|---|---|---|

| Afghanistan | Albania | Burma (Myanmar) | Burundi |

| Central African Republic | Cuba | Iran | Kosovo |

| Lebanon | Libya | Mali | Midway Islands |

| North Korea | Republic of the Congo | Samoa | Somalia |

| Sudan | Syria | Vatican City State | West Bank |

| Western Sahara | Yemen | Zambia | Ukraine |

| Russia | Vietnam | ||

Think Capital scaling plan Explained

The scaling plan with Think Capital involves increasing the starting balance by a fixed percentage of the initial balance at regular intervals, after achieving 10% performance every 3 months, ensuring predictable growth. For example, if the initial balance is $100,000 and the scaling rate is 20%, each scaling event adds 20% of $100,000 (which is $20,000). After the first event, the balance grows to $120,000. Following the second event, $20,000 is added again, making it $140,000, and so on. This approach maintains consistent increments regardless of the total balance, resulting in clear and manageable growth.

What Instruments Are Available To Trade?

Think Capital offers Forex, commodities, indices, stocks, bonds, cryptocurrencies, and many more as trading instruments, with all of them being different and providing room to traders to trade on different markets. You will find a complete listing of the instruments available for trading below.

Is Think Capital the Right Choice for You?

ThinkCapital is a prop trading firm that empowers traders by providing substantial leveraged accounts, allowing them to build personal wealth and withdraw up to 90% of profits. Partnered with ThinkMarkets, a multi-regulated broker, ThinkCapital offers a secure trading environment with advanced tools like TradingView integration. Traders can choose from various evaluation programs, such as the Lightning, Dual Step, and Nexus challenges, to access significant funding and scale up to $1 million. The firm emphasizes democratizing trading, making it accessible to skilled traders regardless of their financial background, and supports them with timely payouts and advanced trading platforms. ThinkCapital is an ideal choice for traders seeking substantial funding, advanced trading tools, and the opportunity to maximize profits

Check Here to see reviews about industry leading proprietry firms in 2025.